If you run a Nonprofit Organization & got a tax-exempt status, you don't require to pay taxes for your organization income, although you are required to comply with the Federal Regulation by submitting a summary of your organization’s income and expenses through Form 990.

Advantages for Nonprofits & Tax-Exempt Organizations in Filing Form 990

Form 990 is a trustable source for your Organization and it should be available for public inspection, thus it provides an easy way for donors and other people to find the right Nonprofits to support for a particular cause.

Let's see about the brief summary of Form 990 and how the filing of Form 990 can be simplified.

The IRS requires Nonprofits & Tax-Exempt Organizations to report the following information with Form 990

- All income & expenses, award scholarships or grants must be included in the statements on the money they’ve awarded and the purpose for that funding.

- Salaries of the five highest-paid employees are required to report on Form 990 as well as any compensation board members received for work performed for the nonprofit.

- Other required information includes the organization’s largest donations for the fiscal year, the nonprofit’s address information, and individual fundraising event performances.

Types of Form 990 for Nonprofits & Tax-Exempt Organizations

Form 990 varies based on their Financial activities. You can find the right 990 Form for your organization based on the following information.

- Organizations having gross receipts less than or equal to $50,000 file Form 990-N.

- Organizations with gross receipts which is less than $200,000 and $500,000 in total assets need to File Form 990-EZ.

- Organizations with gross receipts more than or equal to $200,000 or total assets more than or equal to $500,000 need to file Form 990.

- Exempt & Taxable Private Foundations and Non-exempt Charitable Trusts are treated as private foundations need to file Form 990-PF by the IRS.

Also Please Read: How to E-File 990-N in 3-Steps

Also Please Read: How to E-File 990-N in 3-Steps

When Do You Need to File the 990?

You must file your 990-N, 990, 990-EZ, or 990-PF by the 15th day of the 5th month after your accounting period ends. Find Your Organization Due Date

For Example: If your organization runs with a calendar Tax Year (Jan - Dec) you must file Form 990 by May 15.

Note: It's important that you file Form 990 on time. If you don't file for three years consecutively, IRS will revokes your tax exempt status.

Many nonprofits lost their tax-exempt status in recent years because they did not file a 990 on the required date. To maintain the Exempt status you need to file 990 to report your organization income & expenses every year on time.

990 Additional Information

When Filing Form 990, IRS requires you to add additional information of your Organization like Public Charity Status and Public Support, contributors information and even more. It can be achieved through 990 Schedules.

For Example, if you run a hospital organization, you need to attach the Schedule H while filing your Form 990.

How can I complete my 990 Form Information with the IRS?

You can file 990 information returns either by paper or online. The IRS suggests to e-file the 990 returns. Start using an IRS-authorized e-file provider like expresstaxexempt.com as it significantly reduces the effort and time it takes to prepare and file a 990 form.

If you choose to file electronically, you can avoid more paper works and also avoid waiting in a long queue to submit your Forms. Also, you can avoid attaching schedules separately if you choose to file with the interview style filing software providers as it is generated automatically.

E-File Form 990 in Simple & Secure way with ExpressTaxExempt

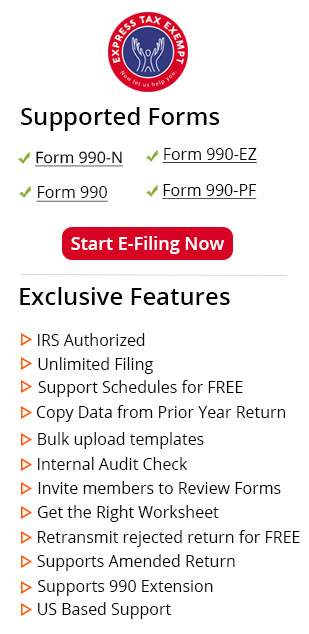

As an IRS Authorized e-file provider, Thousands of Nonprofits choose ExpressTaxExempt to file Form 990 securely. ExpressTaxExempt is a market leader in the e-file industry where thousands of nonprofit organizations' choose to file their information returns online.

Nonprofits & Tax-Exempt Organizations can begin preparing their 990 forms by entering their basic organization information. At ExpressTaxExempt, you can complete your 990 forms quickly and easily with a step-by-step, interview-style process.

Why ExpressTaxExempt to file 990 Electronically?

- Unlimited Form Filing under one account

- 3-Steps 990-N Filing process

- 990 Schedules are auto-generated & FREE

- Copy Data from Prior Year Return

- Upload your employees, contribution data in bulk

- Internal Audit Check

- Invite members to Review & Approve Forms

- Get the Right Worksheet

- Retransmit your Rejected Return for FREE

- Support Amended return

- Support Extension Form 8868

- U.S. based customer support

Please visit ExpressTaxExempt.com to get started your 990 Form